e-Transport Solution

The lack of compliance with the legal requirements regarding RO e-Transport is sanctioned with a fine of up to 100,000 RON, as well as with the seizure of the equivalent value of the undeclared goods.

Are you directly impacted by the Ro e-Transport reporting system?

The e-Transport Solution app developed by PwC Romania is a preconfigured platform that automates the processes required for reporting in the Ro e-Transport system and facilitates much faster, simpler and less costly compliance with your legal obligations.

The app integrates with companies’ business solutions and connects to the National Agency of Fiscal Administration (ANAF) IT system. It collects, validates and aggregates data from your systems and those of your business partners to generate the ITU code.

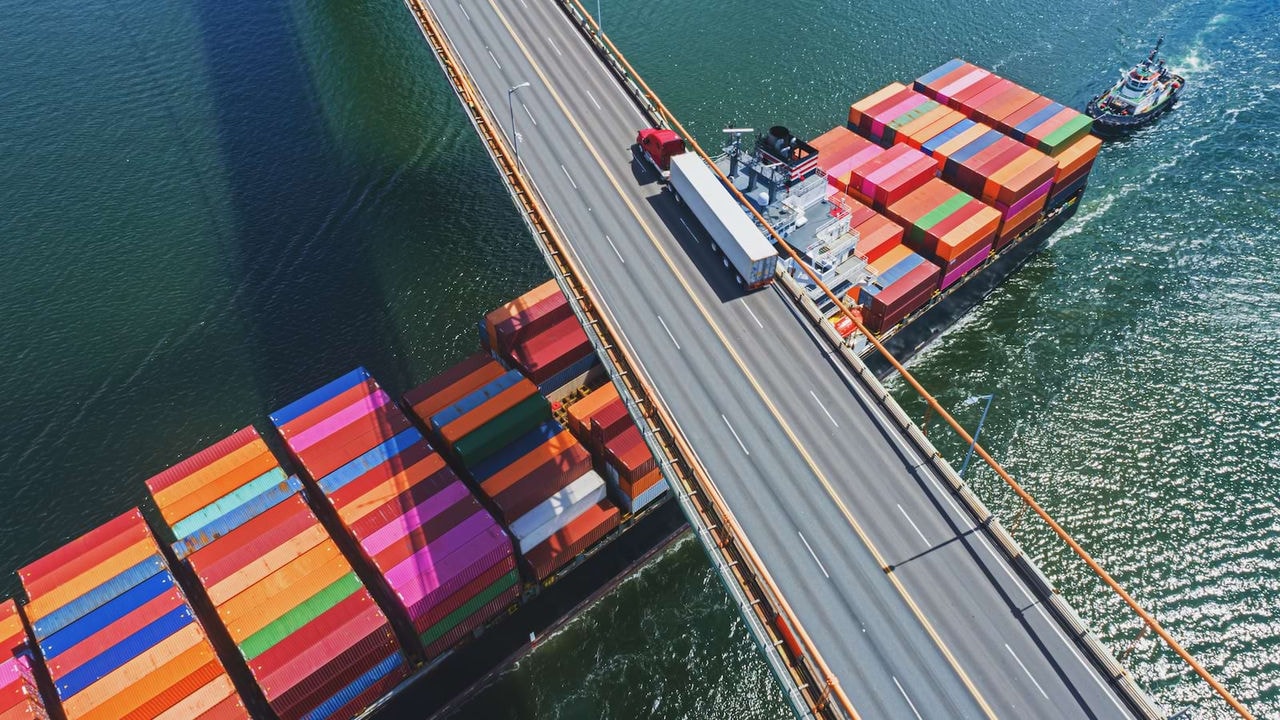

The international road transportation of goods, involving both import-export customs operations and intra-Community transactions (purchases, and intra-Community deliveries respectively), was included in the scope of RO e-Transport obligations starting this year. For more about the conditionalities of the RO e-Transport system read here.

The advantages of PwC’s e-Transport Solution

It significantly reduces the time required for reporting on the RO e-Transport platform.

It eliminates the risk of errors.

It provides extensive reporting, integration and data modification functionalities.

It can be accessed from any device and used from anywhere.

It is a software-as-a-service (SaaS) solution.

If you are interested in the e-Transport Solution, please enter your business contact details here. Our experts will get back to you soon.

What is the RO e-Transport system? Businesses must comply with both the requirements related to the transport of goods with a high fiscal risk on the national territory introduced in 2023, as well as with the obligations related to the international road transportation of goods that apply from 2024. You can learn more by reading the article here.

The e-Transport Solution app was created by:

Contact us